Welcome

So now you have entered the world of economics--or are attempting to--or you just stumbled into this blog by pure chance. Well, since you are here, you mines as well see what this page is about.

I wanted to clear up some terms you might have heard on the news or someone saying and was curious as to what exactly they were saying. Here is my best explanation.

Terms

Numismatics

The study of or related to coin collecting including foreign.

Numismatic Coin

A coin of some value that is highly collectable. Usually your limited edition / hard to find coins.

Graded Coins

Coins that have been professionally evaluated by qualified people and assigned a number based on their condition. MS 70, for example, is a flawless coin. MS 69 is an almost perfect coin. MS 68 and so on means the coin is less than perfect. Professionally graded coins are placed inside a sealed, plastic container with the grader's logo above it. It is also assigned a serial number to prove its authenticity. Some of the more well known graders are below:

- PCGS

- NGC

|

| Another company that has built up a good, solid reputation like PCGS. |

It is also worth noting that some coins struck on the same year will have different labels. For example, you may see Early Release, First Strike, and __th Anniversary. You may also notice that at times there are different labels on the same year coins (American Eagle, Golden Gate Bridge, Brown Label, etc). They all have their different values and meanings. If you are a collector, it might be worth looking more into the value of specific labels. I've shown a few below before ending this lengthy section.

Before I end this segment, I wanted to quickly give a shout-out to PF Graded Coins (Proof). Basically, coins that are minted as proofs are created and lathered with special dies that give them a shiny, mirror like appearence. They are not circulated (like all coins that come directly from the mint). Below is an example of what a proof, graded coin may look like. Please note, like all coins, proof coins do not have to be graded.

Spot Price

How much physical silver is currently worth on the commodity markets. This price is live and tends to fluctuate often.

Premium

How much more the coin cost above Spot Price. For this example, we'll say the spot price of silver is $29.00. Gainesville coins charges an additional $2.75 above spot price for ASE (American Silver Eagles) which would be considered the premium. So the total cost of that one coin would be $31.75.

Intrinsic

I love Webster's definition. Anyway, to make it more clear, intrinsic--in the terminology of coins--value defines how much the physical object's properties are worth. For example, a 90% silver dime has a face value of 10 cent, but we all know it's worth more than 10 cent (it's over $2.00). That is because of the coin's intrinsic value--the material that makes up the coin. For a better explanation, check out my children's book (ha ha, shameless promotion)

Fiat Currency

A currency that has no backing. For example, the USD. What does it mean though if your currency has nothing backing it up? That means that you are taking my word on faith that if I say a $1.00 bill is worth $1.00 then it is worth $1.00.

Our currency used to be backed by gold & silver (Hence, the Gold Standard). That meant we could go down to our local banks and exchange our paper money (silver certificates back in the days) for physical gold and silver. For example, a $1.00 Silver Certificate could be exchanged for 1 oz of silver. When we left the gold standard in 1971, our $1.00 Silver Certificates became $1.00 Federal Reserve Note.

|

| Real USD |

|

| Fake--I mean, fiat, USD. |

Why did we leave the Gold Standard? Because the government was allowing the Feds to print more money than we had gold and silver to back it up with. People realized this and began cashing their silver certificates in the bank for physical metals and depleting their supply of physical metals. President Nixon realized this and ended the Gold Standard, giving the Feds free liberty to print as much paper money as they wanted bringing us to today's current, inflated economy (this is an extreme overview though. Much happened between that time so it's worth looking into).

Market Terms

I am not really the one to attempt to explain this to you as I feel I do not have enough knowledge in this field to talk about it. However, I can give you an overview of what these terms mean.

Commodity Market

This market deals with 'soft' and 'hard' physical assets. Soft commodities tend to be agriculture or livestock whereas 'hard' commodities tend to be your metals (gold, silver, platinum, etc).

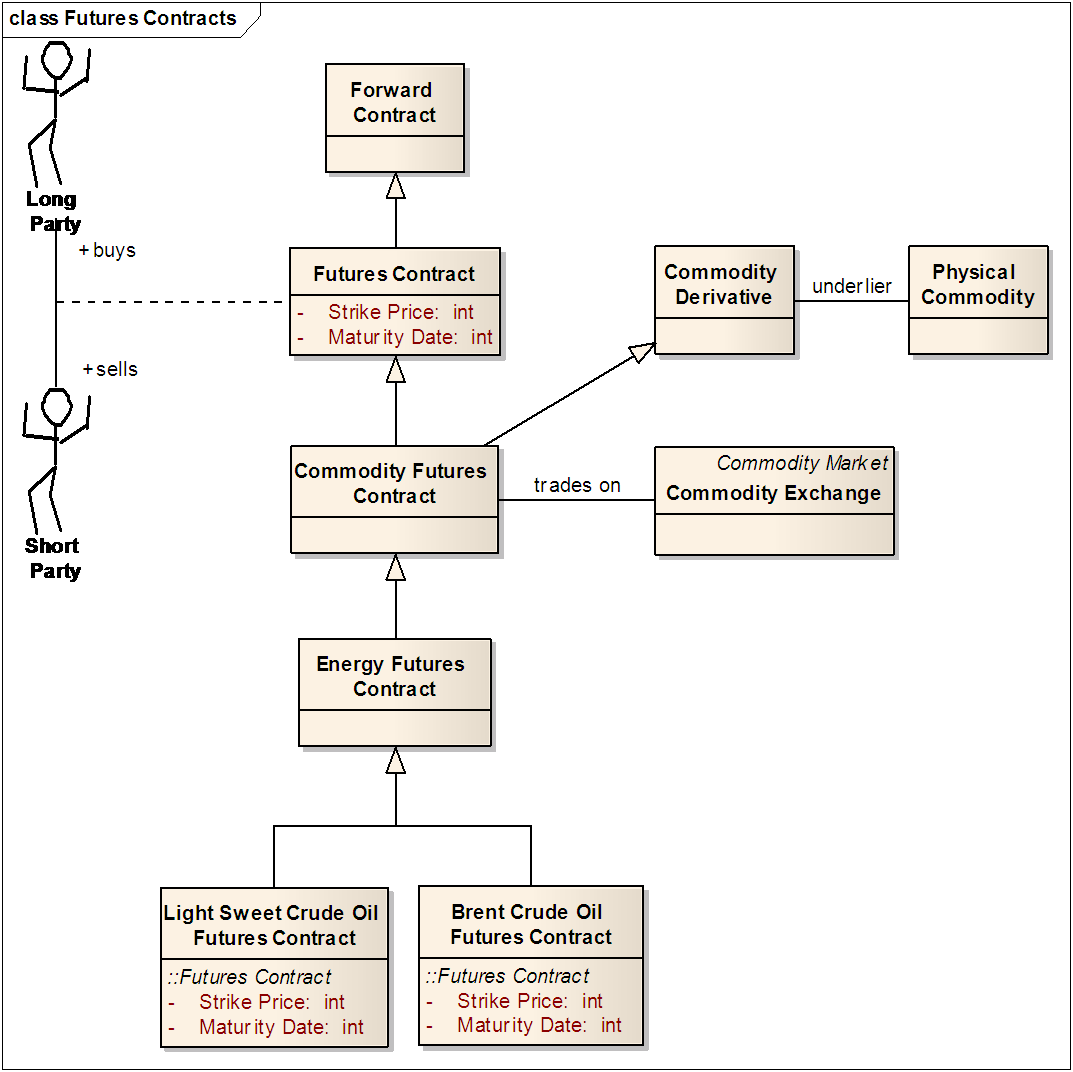

Future Markets

People buying or selling commodities / future contracts that are to be delivered at a specific date (aka: the future).

Future Contracts

To put it simply, it is person A (a business / company / individual (?), etc) buying a commodity from another person (B) at a per-determined price in the form of a contract. It is people betting against the market price of an item in the future.

For example:

Person A wants to buy 1,000 ounces of silver from Person B within 1 year at $29,000. Person A bets against the markets and thinks silver will raise in value above $29.00 an ounce by next year. Person A makes a contract with Person B. Now, Person B thinks silver will go down by next year, making a clean profit off of it.

6 months go by and the spot price for silver is $35 an ounce. Person B starts freaking out, seeing how high silver is and fears silver may go even higher. He calls Person A and asks if he'd settle the contract now for cash. Person A agrees. Person B pays Person A $35,000.

Long

Holding on to a contract for a long time (years). Believe in stock going up in price.

Short

Not a long term contract. They sell in hopes the stock will continue to go down.

The Bull Verses the Bear

Man, the DOW is sure looking bullish right now, aint it? When one says a market is looking bullish they are implying the market is going up or expected to go up.

When one says it is a bearish market, they are implying the stocks are going down and things aren't looking too good in the future for them.

Well, that's all for now. If there are any terms you think might be usual here send me a message or comment below.

This is to be used as just a guide or a beginning point for you to do your own research.